Ever lost sleep over whether your indie short could bankrupt you if someone tripped on set? Yeah, us too.

Filmmaking is a thrilling journey filled with creative highs and logistical lows. But one wrong move—like an actor injuring themselves or equipment damage—and your passion project might turn into a financial nightmare. That’s where impact insurance comes in. In this guide, you’ll discover how impact insurance protects filmmakers like you from unexpected disasters while keeping budgets intact. By the end of this post, we’ll cover:

- What makes film production insurance so vital.

- A step-by-step breakdown for securing the best coverage.

- Tips to avoid costly mistakes (yes, there are bad ones!).

- Real-world examples showing why impact insurance pays off.

Table of Contents

- Key Takeaways

- Why Film Production Insurance Matters

- Step-by-Step Guide to Securing Impact Insurance

- Best Practices for Navigating Film Insurance

- Real Stories: When Impact Insurance Saved the Day

- FAQs About Impact Insurance

Key Takeaways

- Impact insurance safeguards against accidents, liabilities, and unforeseen events during filming.

- Choosing tailored policies minimizes costs without sacrificing protection.

- Ignoring insurance can lead to budget blowouts or even project cancellations.

- Smart planning ensures smoother shoots—even when Murphy’s Law strikes.

Why Film Production Insurance Matters

Let me paint you a picture: Picture this—you’re two days into shooting a horror flick when your leading lady slips on some fake blood and sprains her ankle. Cue chaos. Not only do you now have medical bills piling up, but reshooting scenes will burn through your remaining budget faster than a boom mic falling on cue cards.

This isn’t just hypothetical drama—it happens more often than you’d think. According to industry reports, nearly 30% of independent films face setbacks due to uninsured mishaps. And these aren’t minor hiccups; they’re catastrophic enough to derail entire productions.

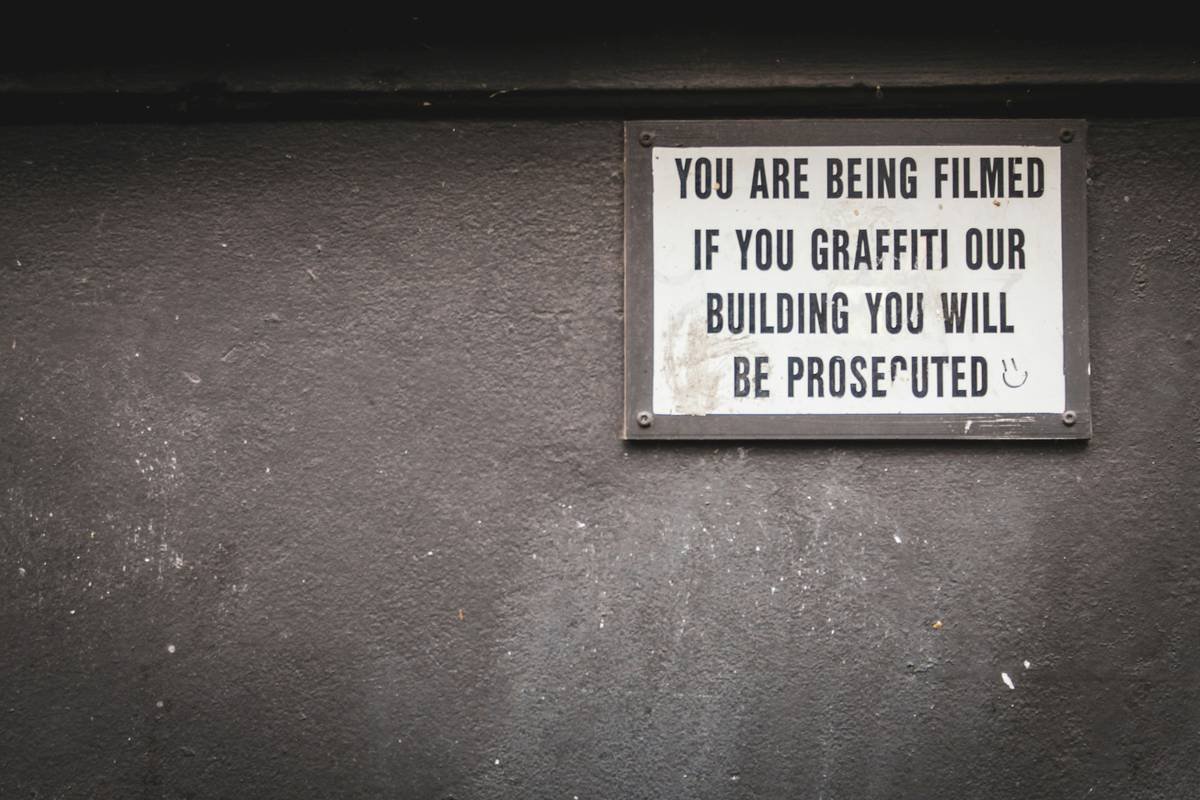

A classic “what not to do” moment captured mid-shoot.

The Confession Corner:

I once advised a friend producing his first feature NOT to get insurance because it seemed pricey at the time (*cringes retrospectively*). Long story short, a drone crashed onto a car mid-scene, and guess who had to pay out-of-pocket reparations? Yup, my wallet still hasn’t forgiven me.

Optimist You: “But doesn’t insurance eat away half my budget?”

Grumpy Me: “Ugh, maybe—but losing all your funds after one accident sounds worse, trust me.”

Step-by-Step Guide to Securing Impact Insurance

1. Assess Your Risks

Different projects carry different risks. Is your shoot outdoors? Indoor stunts involved? Knowing potential hazards helps tailor the policy to fit your needs—no overpaying for irrelevant clauses here.

2. Shop Around

Not all insurers understand the quirks of filmmaking. Stick with providers experienced in film production insurance and request custom quotes based on your specific scenario.

3. Understand Policy Types

Common types include:

- General Liability: Covers third-party injuries/damages.

- Equipment Coverage: Protects cameras, lighting gear, etc.

- Cast Insurance: Compensates for talent-related delays.

Pro tip: Bundle them together for better rates!

4. Read the Fine Print

Seriously. Do not skip this part unless you want a nasty surprise later. Look for exclusions that could leave you vulnerable (like pre-existing conditions not covered).

Best Practices for Navigating Film Insurance

Here are three golden rules:

- Always disclose EVERYTHING upfront. One lie = invalidated claim. RIP savings.

- Keep meticulous records—footage logs, receipts, contracts—as proof should something go wrong.

- Consult professionals before finalizing any agreements. Their expertise saves headaches down the line.

A Terrible Tip (Don’t Do This):

Someone once told me, “Why bother insuring extras? They’re expendable.” Spoiler alert: THIS IS HORRIBLE ADVICE AND SHOULD NEVER BE FOLLOWED. Everyone deserves protection—period.

Real Stories: When Impact Insurance Saved the Day

Case Study #1: A documentary crew was filming wildlife in Alaska when their camera operator got frostbite. Thanks to comprehensive cast insurance, they were able to delay filming until recovery—with no extra expenses!

Case Study #2: An indie comedy set caught fire due to faulty wiring (*cue dramatic music*). General liability insurance covered repairs AND compensated neighboring businesses affected by smoke damage.

FAQs About Impact Insurance

Q1: How much does film production insurance cost?

A1: Costs vary widely depending on factors like duration, location, and risks associated. Expect anywhere between $2,500–$10,000 per production.

Q2: Can’t I just self-insure instead?

A2: Technically yes, but that’s essentially gambling with your life savings. Self-insuring means personally covering every single incident—a risky move unless you’re Elon Musk levels rich.

Q3: What happens if I don’t file claims properly?

A3: Improper filings = denied claims. Always follow documentation guidelines carefully—trust us, it’s easier than challenging denials later.

Conclusion

In the unpredictable world of filmmaking, impact insurance acts as both safety net and lifeline. From accidental damages to lawsuits, having the right coverage keeps you focused on what truly matters: creating amazing content.

- Assess risks thoroughly before choosing a plan.

- Avoid shady shortcuts—they always backfire spectacularly.

- And remember, while insurance feels boring AF compared to crafting killer scripts—it’s anything but optional.

Like a Tamagotchi, your production needs daily care—including smart financial decisions. Now go forth and create cinematic magic… safely!