“Ever scrambled to update your film insurance last minute because winter storms hit while you were still covered for summer heat waves? Yeah, we’ve all been there.”

Filmmakers juggle more than scripts and shot lists—they’re also responsible for keeping projects financially safe. That’s where seasonal adjustments come into play when managing film production insurance. If you haven’t thought about how changing seasons affect your coverage needs, buckle up. This guide dives deep into everything from understanding seasonal risks to optimizing policies for year-round peace of mind.

- Key Takeaways

- Why Seasonality Matters in Film Production Insurance

- How to Adjust Your Policy with the Seasons

- Best Practices for Managing Seasonal Risks

- Real-Life Examples of Seasonal Mishaps

- FAQs About Seasonal Adjustments in Insurance

Key Takeaways

- Seasonal Adjustments: Update your film production insurance policy regularly to reflect unique seasonal risks.

- Risk Factors: Weather changes, location shifts, and equipment demands vary throughout the year.

- Actionable Steps: Review contracts annually and consult insurers before shooting outdoors during extreme conditions.

Why Seasonality Matters in Film Production Insurance

Film shoots are unpredictable beasts, especially when Mother Nature decides to throw a tantrum. Think about it—summer floods in Florida vs. freezing temps on Canadian sets. These environmental shifts demand tailored protection for every shoot.

A confession: I once ignored a “small detail” in my client’s policy renewal—one storm later, their entire lighting rig was damaged, leaving them liable for repairs. It wasn’t pretty. Lesson learned? Risk assessments must align with real-world scenarios.

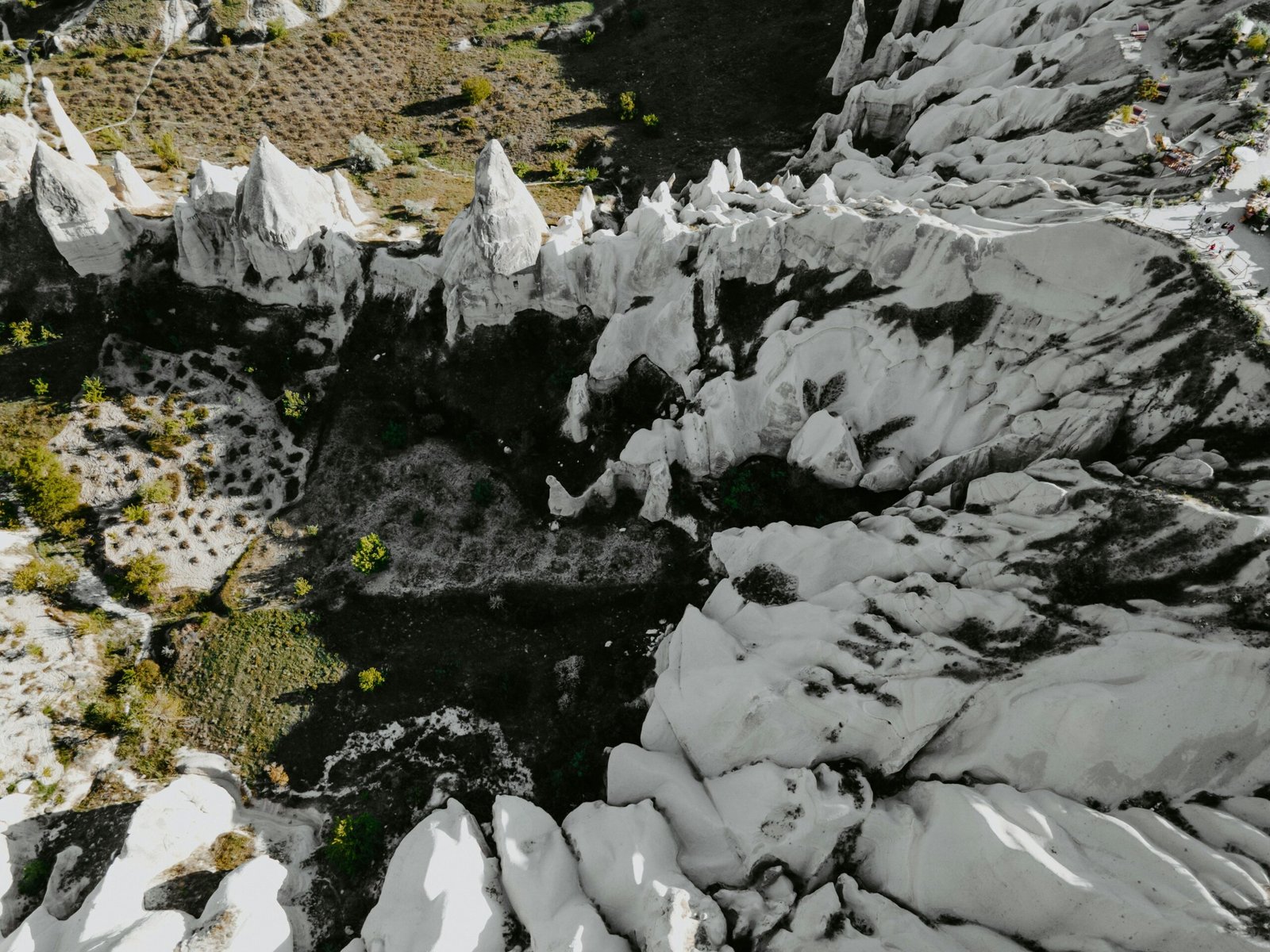

A breakdown of potential seasonal hazards faced during different parts of the year.

How to Adjust Your Policy with the Seasons

- Evaluate Shooting Locations: Are you heading somewhere prone to hurricanes? Or perhaps desert sands pose overheating threats? Match coverages accordingly.

- Update Equipment Lists: Winter gear might not match what’s needed for humid summers. Ensure all tools are accounted for seasonally.

- Speak to Brokers: They know trends and updates better than anyone else. Ask questions even if they seem dumb (spoiler alert: none are).

Optimist You: “Just follow these steps!”

Grumpy You: “Easier said than done, but yeah, let’s roll.”

Best Practices for Managing Seasonal Risks

- Prioritize Communication: Keep your team looped in on any changes to insurance terms or requirements.

- Maintain Records: Store documentation digitally so everyone has access, regardless of who’s on-site.

- Don’t Skimp on Training: Equip cast and crew with knowledge about emergency protocols linked to specific dangers tied to timeframes.

Bonus Tip: Avoid outdated practices like waiting until the last minute to review policies; doing so is asking for trouble.

Real-Life Examples of Seasonal Mishaps

Let me share a quick story from our archives. A small indie crew filming in Colorado underestimated avalanche warnings during springtime snowmelt. Their general liability didn’t include provisions for such natural disasters, resulting in costly legal battles afterwards. Moral of the story? Don’t wing it!

The financial cost difference between properly insured vs underprotected productions.

FAQs About Seasonal Adjustments in Insurance

Q: Can I skip reviewing my policy mid-year?

Nope. Skipping reviews could leave gaps in coverage that aren’t obvious until it’s too late.

Q: Is climate change affecting film insurance costs?

Absolutely. Extreme weather patterns mean higher premiums and stricter policy adjustments. Consider this a good incentive to reduce carbon footprints!

Q: Does renter’s insurance cover filming at home bases?

Typically, no—but some renters’ plans offer add-ons worth exploring depending on scope.

Conclusion

By now, you should understand why seasonal adjustments are crucial for safeguarding your next big project against unexpected challenges brought on by timing quirks. Whether it’s preparing for blizzards or factoring in wildfire zones, staying ahead means saving money—and headaches—in the long run.

So here’s a haiku to wrap things up:

Spring rains flood sets fast,

Summer heat can fry cameras—

Insurance saves the day.