Have you ever seen your dream film project crumble because something went disastrously wrong on set? A camera dropped, an actor injured, or even weather that refused to cooperate? It’s not just bad luck—it’s a lack of preparation. Enter the unsung hero of filmmaking: film production insurance. Today, we’re diving into everything you need to know about crafting the perfect insurance plan for your next blockbuster—or indie gem.

In this guide, you’ll learn:

- Why film production insurance is non-negotiable

- Step-by-step tips for choosing and customizing your insurance plan

- Real-life examples from filmmakers who learned the hard way

Table of Contents

- The Hidden Risks of Film Production

- How to Build the Perfect Insurance Plan

- Top Tips for Navigating Film Production Insurance

- Case Study: When Insurance Saved the Day

- FAQs About Film Production Insurance

Key Takeaways

- A tailored insurance plan can safeguard against equipment damage, liability claims, and unforeseen disasters.

- Including riders (custom add-ons) ensures comprehensive coverage specific to your needs.

- Ignoring insurance could cost you thousands—or ruin your career overnight.

Why Every Filmmaker Needs an Insurance Plan (Even If You Think You Don’t)

I’ll admit it—I once thought I was too small-time to worry about insurance. “What could go wrong?” Famous last words. One day, a light stand toppled onto my brand-new DSLR, shattering its lens. No backup gear, no savings to replace it—just silence on set as everyone stared at me. That’s when reality hit like a sledgehammer. Without an insurance plan, I wasn’t prepared for anything beyond caffeine-fueled editing sessions.

Filmmaking is inherently risky. Actors trip over cables, drones crash mid-flight, and Mother Nature has zero chill. According to industry stats, over 70% of independent productions face unexpected costs related to accidents or property damage. And trust me, these aren’t cheap fixes. A single lawsuit for workplace injury can tank your budget faster than you can say “Action!”

Figure 1: Common risks faced during film production.

“Optimist Me:* ‘Maybe nothing bad will happen! Let’s wing it!’

Grumpy Me:* ‘Yeah, right. Get an insurance plan, or prepare to cry into your coffee later.'”

Building Your Dream Insurance Plan: Step-by-Step Guide

Crafting a solid insurance plan might sound overwhelming, but it doesn’t have to be. Follow these steps to protect your creative vision—and your wallet:

Step 1: Assess Your Unique Risks

Every production is different. Are you shooting stunts? Using expensive lenses? Filming outdoors? Identifying potential pitfalls helps tailor your policy.

Step 2: Understand Types of Coverage

- Equipment Insurance: Covers cameras, lights, microphones—you name it.

- General Liability: Protects against lawsuits for injuries or property damage.

- Errors & Omissions (E&O): Essential if your film includes controversial subjects.

Step 3: Customize with Riders

Riders are where magic happens. Add extras like drone coverage or cyber liability protection if needed. Sounds nerdy, but having them means fewer sleepless nights.

Step 4: Compare Providers

Don’t settle for the first quote. Shop around! Companies like Front Row Insurance specialize in entertainment policies.

Tip*: Ask about discounts for short-term projects. Some insurers offer flexible rates for low-budget shoots.

Pro Tips for Mastering Your Insurance Plan

- Read the Fine Print: Yes, boring—but skipping this step is how horror stories start.

- Create a Risk Report: Document potential hazards pre-shoot. Share it with your insurer if possible.

- Ditch Terrible Tip #1: Thinking “I won’t need much coverage” is dangerous. Spoiler alert: You always do.

A Mini-Rant About Underinsured Indie Films

Let’s talk about a peeve of mine: indie filmmakers who skimp on insurance. Look, I get it. Budgets are tight. But would you skip seatbelts while racing through a thunderstorm? Nope. So why risk losing everything by ignoring proper coverage?

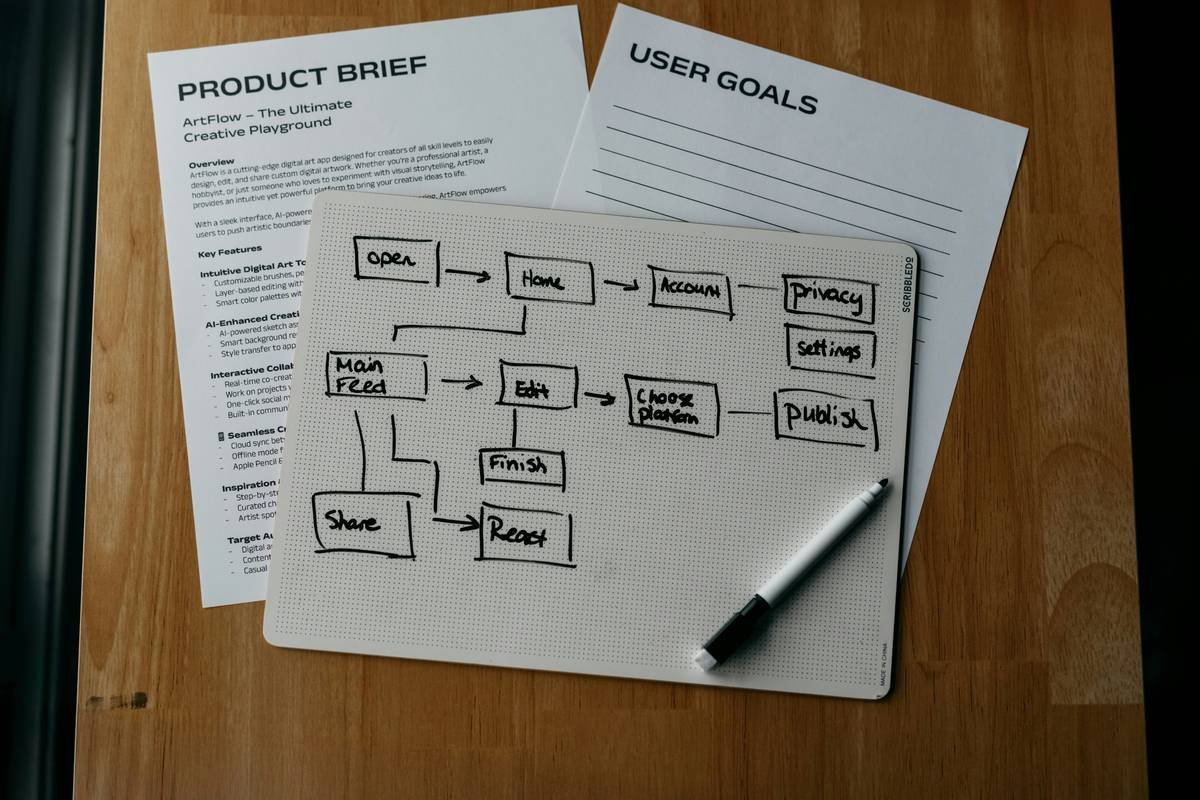

Figure 2: Indie filmmakers discussing the importance of insurance on location.

When Insurance Made All the Difference: A Case Study

Taylor Jenkins Reid (yes, the novelist turned filmmaker) once shared how her team narrowly avoided disaster during a shoot in Malibu. A sudden wildfire forced them to evacuate, destroying valuable props and costumes along the way. Thanks to a robust insurance plan, they recovered financially and finished the project on time. Moral of the story? Insurance isn’t glamorous—but it gets sh*t done.

Figure 3: Film set before and after recovering from wildfire destruction.

FAQs About Film Production Insurance

How Much Does Film Production Insurance Cost?

Premiums vary based on scope, duration, and coverage types. Expect anywhere from $500–$5,000+ per project.

Can I Get Short-Term Policies?

Absolutely! Many providers cater specifically to short shoots or one-off events.

What Happens If I’m Underinsured?

Lots of crying. Jokes aside, underinsurance leaves you vulnerable to major financial losses.

Conclusion

Your film deserves more than crossed fingers for good fortune. By crafting a strong insurance plan, you’re investing in peace of mind—and protecting the artistry that makes filmmaking magical.

To recap:

- Assess risks early and customize accordingly.

- Explore specialized coverage options tailored to your project.

- Learn from others’ mistakes; don’t become another cautionary tale.

Remember, life imitates art—but only if you’ve got insurance backing you up.

And now, because nostalgia never fails:

“Roll cameras steady,

Lightning strikes without warning,

Insurance saves dreams.”